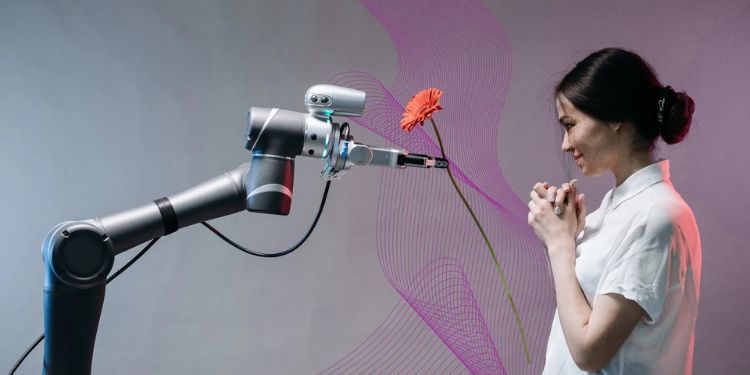

Boon or bane? Is AI more important now than ever? Will it have a lasting impact on humankind? Possibly, the most burning questions that are lingering in everyone’s mind today when it comes to the transformative potential of AI (Artificial Intelligence).

Bosch’s third annual Tech Compass Survey underlines these views, highlighting the growing relevance of AI as a key driver of change world over.

With 64 per cent of global respondents ranking artificial intelligence as the most influential technology in near future, the report reveals a strong sense of optimism among Indians, 76 per cent of whom personally feel prepared for the upcoming era of AI led interventions.

Conducted across Brazil, China, France, Germany, India, the United Kingdom, and the United States, the Bosch Tech Compass survey aims to explore global perspectives on emerging technologies, encompassing people’s attitudes, beliefs, expectations, concerns, and more.

“The survey reflects India’s increasing acceptance and enthusiasm towards emerging technologies like AI,” Guruprasad Mudlapur, President-Bosch Group (India) & Managing Director, Bosch Limited, said. “India is keen on AI-powered solutions across diverse sectors such as sustainability, mobility, manufacturing, and even daily life,” he observed. “At Bosch, we recognize the potential of AI and are committed to implementing it responsibly to deliver a safer experience for everyone.”

For conducting this survey, people aged between 18 and above in seven countries were polled online on behalf of Robert Bosch GmbH by the market researchers Gesellschaft für Innovative Marktforschung mbH (GIM) in December 2023. As many as 2000 people each were polled in India, Brazil China and the US, while it was 1000 people in France, Germany and the United Kingdom.

· India, with 80 per cent opinion, ranked higher than the global percentage of 73 in advocating Generative AI as relevant as the rise of Internet· Asian respondents – with India again leading ahead with 81 per cent – strongly believe that technology as a key solution to climate change.· 59 per cent Indians believe AI will make work easier leading to better outcomes |

Combating climate change: 81 per cent of Indians, and 71 per cent of global respondents feel that technological progress shall be key to combating climate change. Indians strongly believe in the transformative potential of technology in addressing environmental challenges, underscoring the nation’s commitment to leveraging technological solutions for sustainable development.

AI in mobility: Enhanced safety emerged as the most resonant sentiment amongst Indians (51per cent) and global (60 per cent) respondents, when it comes to AI powered integrations in mobility. 48 per cent Indians also expect AI driven solutions to facilitate easier and seamless parking. Among other benefits of AI, global respondents focused on reduced fuel consumption/ greater range (54 per cent) and ADAS features enabling alternative activities while driving (34 per cent).

Transparency in labeling:79 per cent Indians agree on the mandatory labelling of AI content, a belief which echoes strongly across all the geographies surveyed (82 per cent). Bosch is calling for mandatory labeling on any AI-generated content to transparently state its machine origin. This approach fosters transparency, reinforces accuracy, and empowers users to scrutinize and cite the source of AI-generated information.

Embracing AI in unexpected ways: From 70 per cent Indians trusting AI chatbots over acquaintances for solutions, to 62 per cent showing willingness to see AI as stand-up comedians and 73 per cent agreeing to follow AI recommendations for career path, the survey reflects India’s unique interest to integrate AI into daily life experiences.

Hopes and concerns: While Indians expect emerging technologies like 5G (48 per cent) and AI (46 per cent) to have a positive effect on society, there are concerns around the negative impact of humanoid and service robots as well. As much as 56 per cent Indians stressed on the need for education to get prepared for AI and implement it responsibly. The nuanced understanding of complexities around advanced technologies reflects the need for its responsible deployment in future.